Redefining the Purpose of Saving

For years, traditional monetary recommendations has leaned heavily on the concepts of frugality, delayed satisfaction, and hostile saving. From cutting out morning coffee to abandoning vacations, the message has actually been loud and clear: save currently, delight in later on. But as societal worths shift and people reassess what financial wellness actually implies, a softer, a lot more conscious approach to money is acquiring grip. This is the significance of soft conserving-- an arising attitude that focuses much less on stockpiling cash money and more on lining up financial choices with a significant, happy life.

Soft saving does not mean deserting duty. It's not concerning overlooking your future or investing carelessly. Instead, it's concerning balance. It's regarding recognizing that life is taking place currently, and your cash needs to sustain your joy, not simply your pension.

The Emotional Side of Money

Money is frequently viewed as a numbers game, but the way we gain, invest, and save is deeply psychological. From childhood years experiences to societal pressures, our financial routines are formed by greater than logic. Hostile saving techniques, while effective on paper, can sometimes fuel anxiety, shame, and a relentless worry of "not having sufficient."

Soft saving invites us to think about how we really feel regarding our monetary options. Are you avoiding dinner with buddies due to the fact that you're trying to stay with a stiff cost savings plan? Are you postponing that journey you've dreamed about for many years since it doesn't seem "liable?" Soft saving obstacles these narratives by asking: what's the psychological price of severe conserving?

Why Millennials and Gen Z Are Shifting Gears

The newer generations aren't always making extra, however they are reimagining what wide range appears like. After observing monetary economic crises, housing dilemmas, and currently browsing post-pandemic truths, younger people are examining the knowledge of avoiding happiness for a later date that isn't guaranteed.

They're picking experiences over belongings. They're prioritizing mental wellness, adaptable work, and day-to-day satisfaction. And they're doing it while still maintaining a feeling of monetary obligation-- simply by themselves terms. This change has actually triggered even more individuals to reassess what they truly desire from their economic journey: satisfaction, not excellence.

Creating a Personal Framework for Soft Saving

To embrace soft savings, beginning by comprehending your core worths. What brings you joy? What costs truly enrich your life? It could be a weekly supper with liked ones, taking a trip to new locations, or investing in a leisure activity that fuels your imagination. When you recognize what matters most, saving ends up being much less about limitations and more concerning intentionality.

From there, consider developing a versatile budget. One that consists of area for enjoyment and spontaneity. As an example, if you're taking into consideration home loans in Riverside, CA, you don't need to think about it as a sacrifice. It can be an action towards developing a life that feels whole, where your space supports your dreams, not just your monetary objectives.

Saving for the Life You Want-- Not Just the One You're Told to Want

There's no global plan for financial success. What benefit one person may not make good sense for another. Typical recommendations tends to promote large milestones: purchasing a house, striking six figures in cost savings, and retiring early. However soft saving focuses on smaller, a lot more individual success.

Perhaps it's having the adaptability to take a mental health day without financial stress. Possibly it's saying yes to a spontaneous weekend break getaway with your buddies. These moments may not boost your net worth, but they can enhance your life in ways that numbers can not capture.

As even more individuals discover this approach, they're also finding that soft saving can exist side-by-side with wise planning. It's not concerning abandoning savings goals-- it has to do with redefining them. And for those browsing economic decisions-- like researching loans in Riverside, CA, the lens changes. It's no longer just a way to an end, yet part of a way of living that values both security and satisfaction.

Releasing the "All or Nothing" Mindset

One of the biggest challenges in personal finance is the propensity to believe in extremes. You're either saving every dime or you're failing. You're either repaying all financial best site obligation or you're behind. Soft conserving presents nuance. It says you can conserve and spend. You can prepare for the future and stay in the present.

As an example, many individuals really feel overwhelmed when choosing between travel and paying for a car loan. However what if you allocated modestly for both? By making room for pleasure, you may really really feel even more determined and encouraged to stay on track with your economic objectives.

Also picking which financial institutions to collaborate with can be guided by this softer way of thinking. With so many banks in California offering a wide range of product or services, it's no longer practically rate of interest or charges-- it's additionally about finding a fit for your way of living and values.

Soft Saving Is Still Smart Saving

Doubters may say that soft conserving is simply a rebranding of investing a lot more easily. However that's not the situation. It's a critical, psychological, and deeply human method to managing money in such a way that honors your existing and your future. It instructs you to build a cushion without smothering your happiness. It aids you create room in your life to grow, not just make it through.

This doesn't suggest you'll never ever require to be disciplined or make sacrifices. It simply means that when you do, you'll know why. Every buck conserved will certainly have a function, and every dollar invested will certainly really feel aligned with what you value most.

Financial health isn't a goal. It's a continuous procedure of knowing, readjusting, and growing. And as you check out how to take advantage of your sources, soft conserving provides a rejuvenating reminder: your cash is a device, not an examination.

For more insights such as this, be sure to examine back typically and comply with along. There's more to find as you proceed forming a life that's economically sound and psychologically meeting.

Jennifer Grey Then & Now!

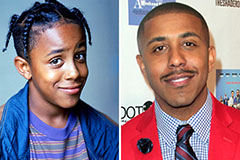

Jennifer Grey Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!